Do you have no direct heirs and want the bulk of your assets not to go to the state but to those in need? Or maybe you do have direct heirs but you also want to make a gesture in favour of those who have nothing? Then make a bequest to the Luxembourg Red Cross.

A bequest is a provision contained in a will that allows you to designate one or more beneficiaries who will be given all or part of your assets. These beneficiaries may be natural persons such as your children or family members, or legal entities, including associations such as the Luxembourg Red Cross.

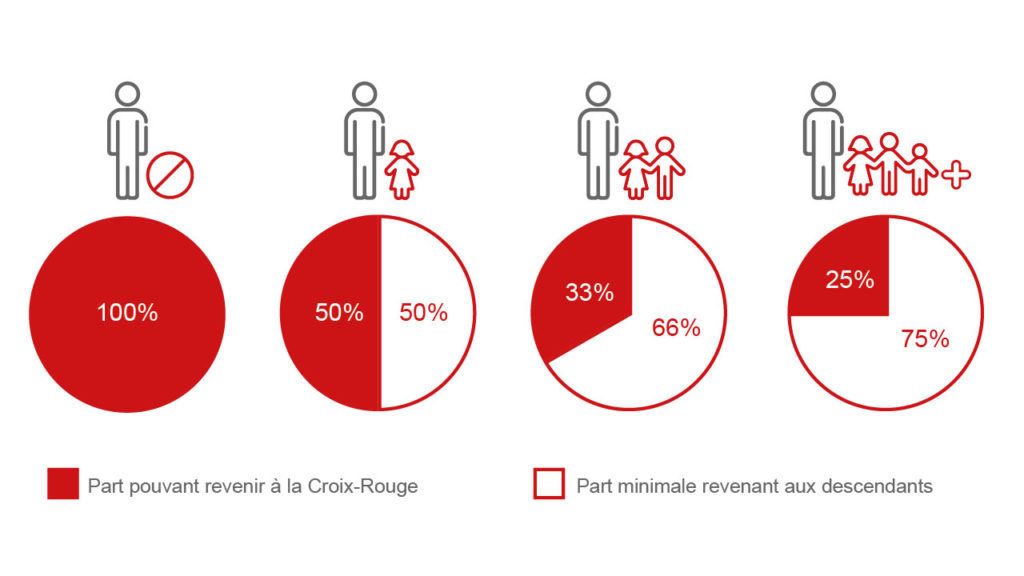

The distribution of your bequest is largely determined by whether or not you have any héritiers réservataires, i.e. heirs statutorily entitled to a certain portion of the estate. You cannot bequeath your entire estate to the Luxembourg Red Cross if you have descendants – children or grandchildren.

The law in fact provides that part of your assets, called the “reserved portion” (part réservataire) or the “reserve” (réserve), must revert to them. The part that you can freely dispose of, the available share, will depend on the number of children you have.

| Number of children | Reserved portion | Available portion |

|---|---|---|

| 1 child | 1/2 | 1/2 |

| 2 children | 2/3 | 1/3 |

| 3 or more children | 3/4 | 1/4 |

On the other hand, if you do not have any heirs who are entitled to inherit, you may freely and entirely dispose of your assets.

Let’s take the following example: you bequeath a house that has a value of € 900,000 at the time of your death.

If you have no children, you can bequeath € 900,000 to the Luxembourg Red Cross.

If you have a single child, 450,000 €.

If you have two children, 300,000 €.

If you have three or more children, 225,000 €.

It should be noted that your parents and grandparents (ascendants) as well as your spouse are not considered by the law to be héritiers réservataires.

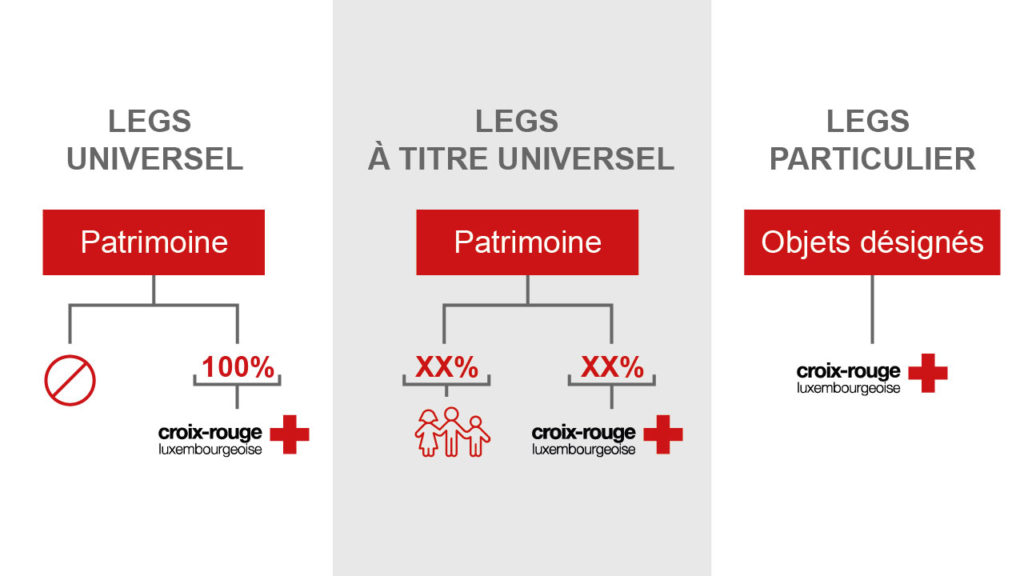

Three types of bequests can be made, depending on your family situation and your wishes.

Sole legatee bequests (Leg Universel). You bequeath your entire estate to one or more persons called “sole legatees”. This type of bequest is only possible if you do not have any descendants (héritiers réservataires).

Within such a bequest, you can also designate specific bequests. In your will, you designate other beneficiaries to whom the sole legatee – the Luxembourg Red Cross, for example – will be responsible for handing over the property you have designated.

Partial bequests (Leg à titre Universel). You bequeath to the Luxembourg Red Cross a share of your estate, expressed as a fraction, percentage or type of property (your real estate, for example). This type of bequest may also be made if you have protected heirs (héritiers réservataires). In such a case, you will have to take into account the reserved portion and the available share to protect your descendants’.

Specific bequests (Leg particulier). You bequeath to the Luxembourg Red Cross one or more designated properties. This may be a house, an apartment, securities, jewellery, bank accounts, a specific sum of money, etc.

To bequeath all or part of your assets to the Luxembourg Red Cross, you must make a will in its favour. It is best to draw it up quickly if you want to guarantee that your last wishes be met. You can change or cancel it at any time if your financial and/or family situation changes.